Actions for Vehicles

Money to help you go electric

49% of Maine’s fossil fuel emissions come from transportation. Federal and state incentives can help you buy an electric vehicle (EV), so you can save money on fuel and maintenance, get an enjoyable ride, and fight climate change.

Incentives for electric vehicles

The Inflation Reduction Act (IRA) creates tax credits and rebates to directly help people transition to cleaner transportation.

New EV

Federal Tax Credits

IRA tax credit 30D provides:

- up to $7,500 for eligible battery (BEV) and plug-in hybrid electric vehicles (PHEV)

To be eligible, new EVs must have a:

- list price of less than $80,000 for vans, SUVs, and pickup trucks

- list price less than $55,000 for all other vehicles

- certain percentage of vehicle materials and assembly made in America

Check updated lists of eligible new EVs

File form 8936 with your tax return

Maine Incentives

Efficiency Maine rebates:

- $3,000 – $7,500 for low-income customers, for qualifying new battery electric vehicles (BEVs) or plug-in hybrid electric vehicles (PHEVs).

Note: Customers seeking enhanced rebates based on income must be pre-qualified before purchase.

Used EV

Federal Tax Credits

IRA tax credit 25E provides:

- 30% of the cost of a used battery (BEV) or plug-in hybrid electric vehicle (PHEV), up to $4,000

Used EV eligibility:

- price of $25,000 or less

Current list of eligible used EVs

File form 8936 with your tax return

Maine Incentives

Efficiency Maine rebates:

- $2,500 for low-income buyers

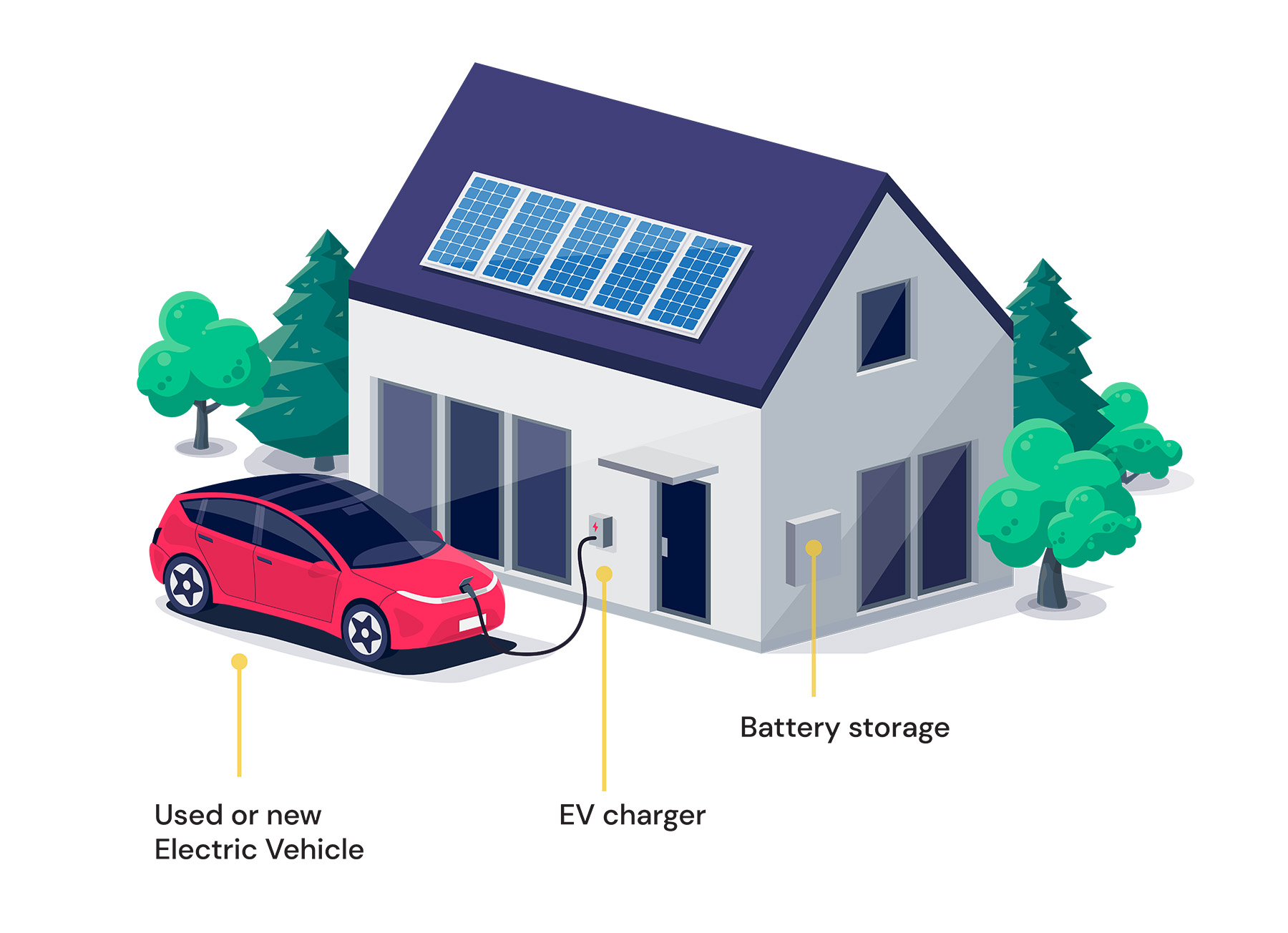

Home EV Chargers

Federal Tax Credits

IRA tax credit 30C provides:

- up to $1,000 for home EV chargers in eligible low-income/non-urban communities. This program is still in development.

- File form 8911 with your tax return

Consult the IRS website for updates.

File form 8911 with your taxes.

To view other ways to make your transportation more climate friendly, see our list!

Downloadable guide

Download our Mainers’ Guide to Climate Incentives (PDF) to get all this information one place, including FAQs and a Getting Started Checklist.

Note: This booklet summarizes current incentives and tax credits available to Mainers through federal and state programs as of January 2025. Programs may change, so please check for updated information before making any purchasing decisions.