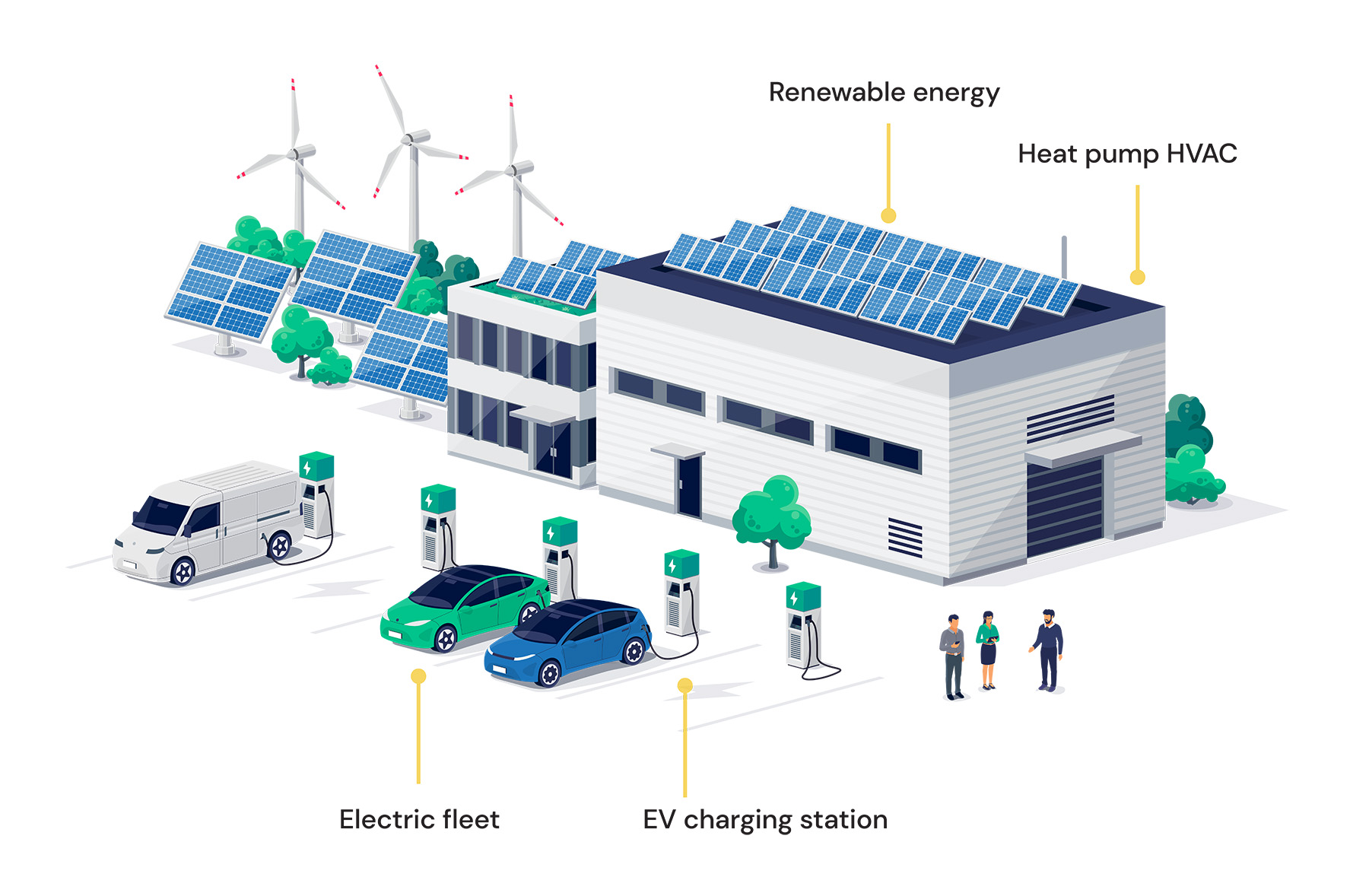

Actions for Businesses

Going Green is Good for your Business

Making your business more climate-friendly doesn’t have to be complicated. Smart investments can save you money while also creating a cleaner future for Maine.

Incentives for climate-friendly business

The Inflation Reduction Act (IRA) signed into law on August 12, 2022, creates tax credits and rebates to directly help businesses adopt cleaner technologies.

Electric Vehicles

Federal Tax Credits

IRA tax credit 45W (Commercial Clean Vehicle Tax Credit) provides:

- up to $7,500 for commercial EVs under 14,000 pounds

- up to $40,000 for commercial EVs over 14,000 pounds (e.g. electric trucks)

Visit the IRS website for full details.

Energy Efficiency

Federal Tax Credits

IRA tax deduction 179D (Commercial Buildings Energy-Efficiency Tax Deduction) provides:

- up to $5 per square foot for energy efficiency projects

Maine Incentives

Efficiency Maine has programs for businesses of all sizes, including multifamily buildings with five units or more and Maine’s largest energy customers. Programs include incentives for “off-the-shelf” efficiency measures, such as lighting, heating, and cooling, as well as incentives for custom options for a business.

For more information, visit Efficiency Maine.

Rooftop Solar

Federal Tax Credits

Solar tax credits for businesses, including the Investment Tax Credit (ITC) and Production Tax Credit (PTC), have been expanded by the Inflation Reduction Act:

- 30% of all costs for rooftop solar

EV Chargers

Federal Tax Credits

IRA tax credit 30C offers:

- 30% of costs for EV chargers, up to $100,000, in eligible low-income/nonurban communities

Maine Incentives

Efficiency Maine has several programs for public and commercial EV charging. For more information, visit Efficiency Maine.

To view other ways to make your home more climate friendly, see our list!

Downloadable guide

Download our Mainers’ Guide to Climate Incentives (PDF) to get all this information one place, including FAQs and a Getting Started Checklist.

Note: This booklet summarizes current incentives and tax credits available to Mainers through federal and state programs as of January 2025. Programs may change, so please check for updated information before making any purchasing decisions.