Home →

Home → Maine Public Library Fund Check-off → Instructions for Tax Software Users

Tax Check-off Instructions for Tax Software Users

Background

For those who file their income taxes on paper, you can make your contribution to the Maine Public Library Fund on schedule "C-P" on your Maine income tax form. If you use TurboTax or H&R Block tax software, the process is a little different. Please see the instructions below.

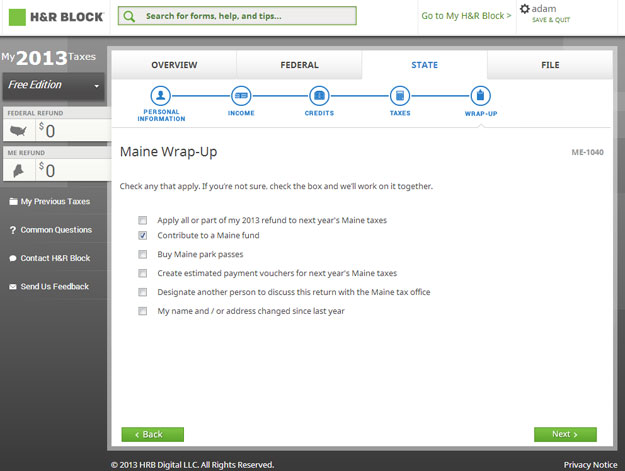

H&R Block

The voluntary contribution questions for H&R Block filers come as they wrap-up the State of Maine portion of their income tax filing.

H&R Block Step 1

When you reach the following screen, make sure that you place a checkmark next to the section that reads "Contribute to a Maine fund." Click the "next" button at the bottom of the screen.

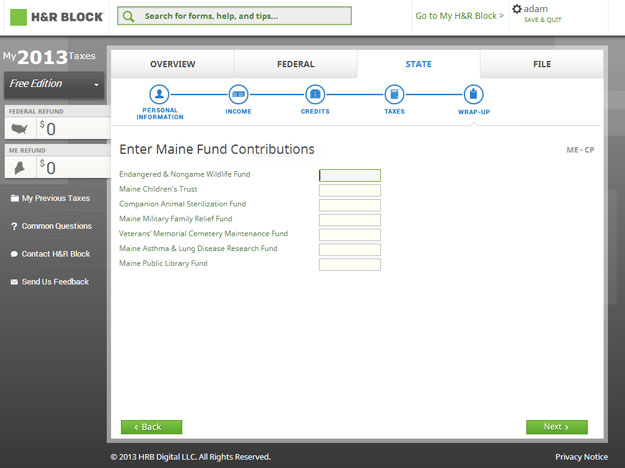

H&R Block Step 2

Type in the amount you would like to contribute to the Maine Public Library Fund on the bottom line of the form. Click the "next" button.

TurboTax

Like H&R block, the TurboTax voluntary contribution questions come toward the end of the process of submitting information for your State of Maine income taxes.

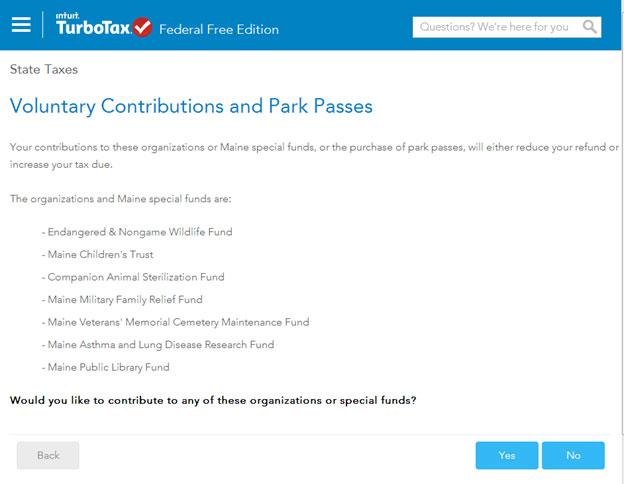

TurboTax Step 1

When you reach the following screen, click the "yes" button to go to the section where you can donate to the Maine Public Libary Fund.

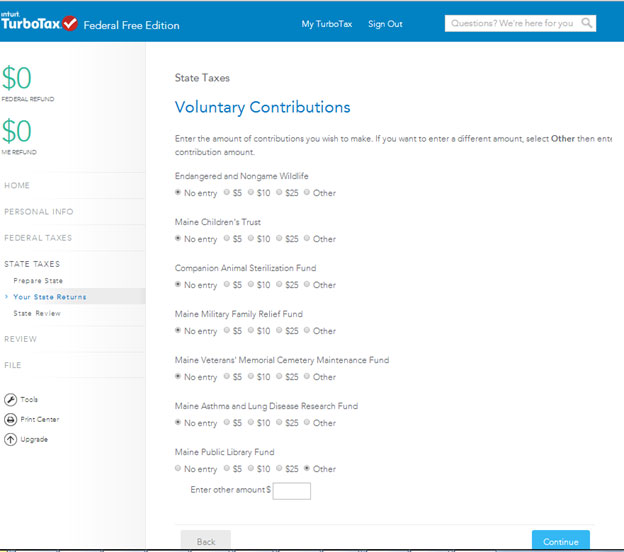

TurboTax Step 2

Now specify the amount you would like to donate. If you check "other" a box will open to allow you to specify a dollar amount of your choice. When you have finished, click the button marked "continue."